Trading has become, for many, a new way to earn additional income. Still, although many want to obtain significant returns on the largest virtual currency, it is necessary to prepare to achieve these goals.

The digital financial market led by cryptocurrencies is complex since it is based on an ecosystem different from that of the traditional economy, where there are no external factors that modify it.

It is a market in which we enter blindly, and only the previous knowledge obtained is what will help us to achieve the desired investment goals.

What is cryptocurrency trading?

Trading is a financial investment strategy applied to the various markets that exist worldwide; in the case of cryptocurrencies, trading works as a strategy for buying and selling digital assets.

The main feature of trading is to make a profit by stimulating the digital financial market with investments, either by increasing or decreasing the price of a specific cryptocurrency.

Trade or operate with cryptocurrencies is through an exchange platform or Exchange-based P2P technology; there are various ways to invest in cryptocurrencies, either through CFDs, ETFs, currency pairs, or simply buying a Bitcoin at low prices and waiting for its increase.

To develop effective trading strategies, it is essential to carry out the respective technical and fundamental analysis of the digital currency you want to invest in establishing a short-term, medium-term trading plan.

Practice in this type and investment will allow you to carry out the most significant number of positive operations in the face of the risks that cryptographic assets represent with considerable volatility.

What does the blockchain represent in trading?

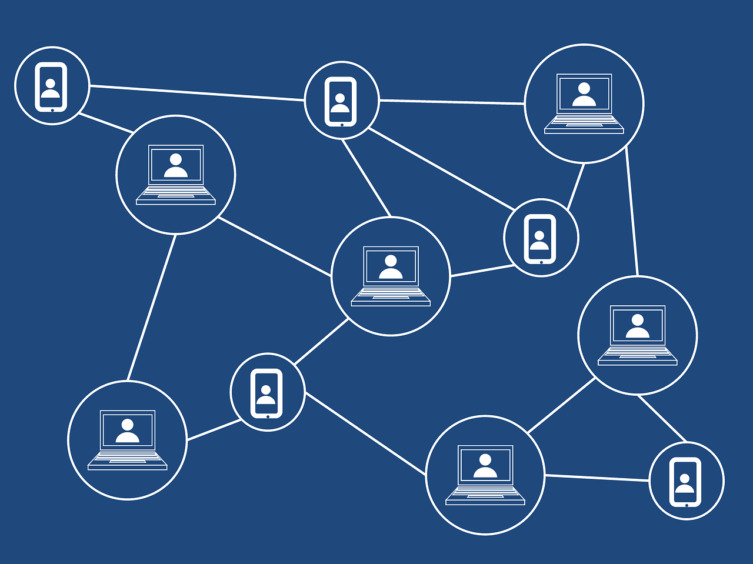

The blockchain is one of the fundamental elements of making investments with digital assets. These are executed under this platform, which offers security in the transactions carried out since they are registered and can be verified by any user’s participants.

The benefits offered by the blockchain in terms of storage and protection of the information generated on this platform cannot be compared with the storage of traditional equipment.

Let us remember that cryptographic operations are based on complex mathematical calculations. The analysis of algorithms leads to the creation of a block that will generate new units of cryptocurrencies to be offered.

From this process, all users of cryptocurrencies benefit by operating through the supply and demand of digital currencies, which will determine the price of the aforementioned digital assets, increasing or decreasing their market capitalization.

Unregulated Exchange Contribute to Crypto Discredit

Another key point when trading cryptocurrencies is investigating the Exchange where we want to carry out our exchange operations.

Unfortunately, many platforms do not have the necessary regulations to guarantee the transactions carried out, which is often harmful and lends itself to money laundering transactions.

For this reason, the term Wash Trading arises, which directly affects investors who carry out their exchange operations; this concept now refers to the unexpected and high increase in the supply and demand of a particular digital currency.

All the processes that allow this strategy to occur are of fraudulent origin because the market is managed at the pleasure of a single user, tending to affect many participants who innocently do not identify at first sight the unscrupulous operations that it throws wash trading.

These types of operations are disabled in the regulated Exchanges, which is why it is advisable to verify the exchange platforms to avoid being victims of scams when investing in cryptocurrencies.

Is the digital market susceptible to market manipulation?

Although it is incredible since the digital market cannot be manipulated by external factors but only the trend that its users give to cryptocurrencies, there are currently investigations into market manipulations of BTC and Ethereum.

How can this happen? Simple through identity theft and laundering trading, these two features harm the reputation of many exchanges conducting their operations transparently.

Conclusion

As more reputable exchanges enter the cryptocurrency market, they will allow the effect of these activities to be diminished that can be considered illicit in a market that is not yet regulated.

Investments in cryptocurrencies require analysis of all the aspects that come together, from registration in the Exchange to the moment in which the profits are obtained and deposited in the wallets.

Want more news from the Tech world for Gaming Peripherals to Hardware Click Here